Cancer treatment rests on three pillars Surgery, Chemotherapy and Radiation, all of these carry high cost. The minimum cancer treatment cost in India is Rs. 5,00,000 it starts from Rs. 90,000 but there are some cancer...

Category - Latest Posts

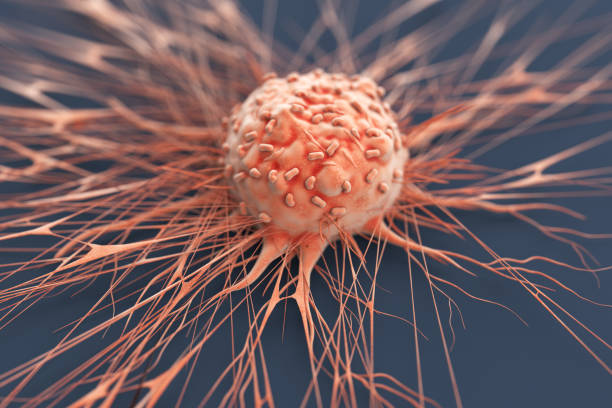

Cancer is a disease, it can start almost anywhere in the body. It is a bunch of old and damage cells that grow and multiply uncontrollably to other parts of the body, these cells forms tumor. Normally, in human body cells...

Hi !! now it’s possible to get free cancer treatment ! Here I am sharing detailed information of cancer hospitals where you can get best cancer treatment at lowest cost. 1. Tata Memorial Hospital, Mumbai. Tata...

Hello Readers, There is no definite cancer type that spreads rapidly because people don’t know about cancer symptoms, so it’s not detected at the right time. Especially the types of cancer that occur in the...